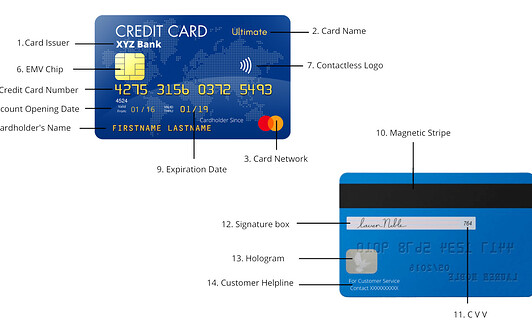

1. Card Issuer’s Name

Found at the top left or right of your card, this is the name of the bank or financial institution that issued the card (e.g., XYZ Bank).

2. Card Name

This identifies the specific credit card you have (e.g., XYZ Bank Ultimate Credit Card).

3. Card Network

The network (Visa, MasterCard, American Express, etc.) determines where your card is accepted and processes transactions.

4. Credit Card Number

A unique 16-digit number (15 for AmEx) used to identify your card. The first 6 digits are the Bank Identification Number (BIN), revealing the card issuer.

5. Cardholder’s Name

The name of the person to whom the card is issued.

6. EMV Chip

The small chip on the front enhances security by encrypting your transaction information.

7. Contactless Payment

The WiFi-like symbol indicates your card can make transactions without physical contact. Just tap if the reader supports it!

8. Account Opening Date

The date your card was issued, shown as MM/YY (e.g., 01/24).

9. Expiration Date

The date by which you need to renew your card, also in MM/YY format (e.g., 01/19).

On the Back of the Card:

10. Magnetic Stripe

Contains your account information. Used when you swipe the card for transactions.

11. CVV

A 3-digit (or 4 for AmEx) security number that verifies online transactions. Keep it confidential!

12. Signature Box

Located on the back of your card, this is where you sign your name. It helps to verify your identity and validate transactions in cases where a physical signature is required, such as at a point-of-sale terminal.

13. Hologram

A security feature to prevent fraud. It’s tough to duplicate and unique to each card.

14. Customer Helpline Number

A general number for queries or assistance with your card.

Understanding these details can help you use your credit card more effectively and securely!