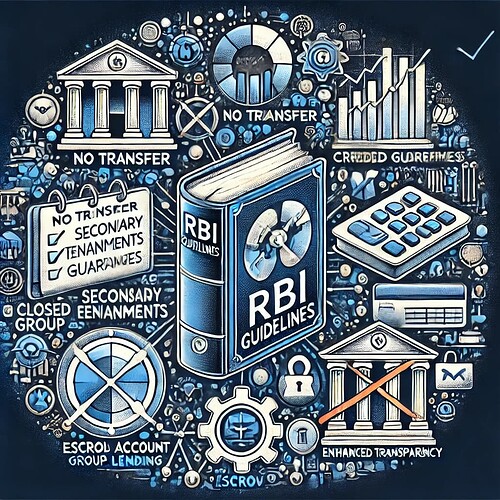

RBI’s New Guidelines: Essential Information

The Reserve Bank of India (RBI) has recently tightened regulations on NBFC-P2P lending platforms to address some concerning practices in the industry. These updated guidelines aim to strengthen the regulatory framework, providing greater protection for both lenders and borrowers.

Key highlights of the RBI’s revised guidelines include:

-

Secondary Transfer Ban: RBI has observed that many P2P platforms were facilitating instant liquidity by transferring loans to another lender, providing a secondary exit. This practice, which goes against the core principles of P2P lending, is now immediately prohibited.

-

Prohibition of Credit Enhancement and Guarantees: NBFC-P2Ps are now explicitly barred from offering or arranging any form of credit enhancement or guarantee, ensuring that the entire risk of the loan is borne solely by the lender.

-

Ban on Closed Group Lending: RBI has banned closed group tie-ups with fintechs, which were directing loans exclusively to specific borrowers.

-

Mandatory Use of Bank-Promoted Trustee: All fund transfers between lenders and borrowers must now occur through an escrow account managed by a bank-promoted trustee, ensuring secure and transparent transactions.

-

Enhanced Transparency: P2P platforms are now required to publicly disclose their portfolio performance, including non-performing assets (NPAs), on a monthly basis.