IDFC First Bank has announced some significant changes to its credit card payment terms and fee structure, which will take effect from the August 2024 statement cycle. These updates primarily concern the Minimum Amount Due (MAD) and the Payment Due Date. Here’s what you need to know:

Revised Payment Due Date

The Payment Due Date on IDFC First Bank Credit Cards will now be 15 days from the statement generation date instead of the previous 18 days. This change will be implemented starting with the August statement cycle.

- Old Due Date: 18 days from statement generation

- New Due Date: 15 days from statement generation

- Effective From: August 2024 statement cycle

Revision in Minimum Amount Due (MAD)

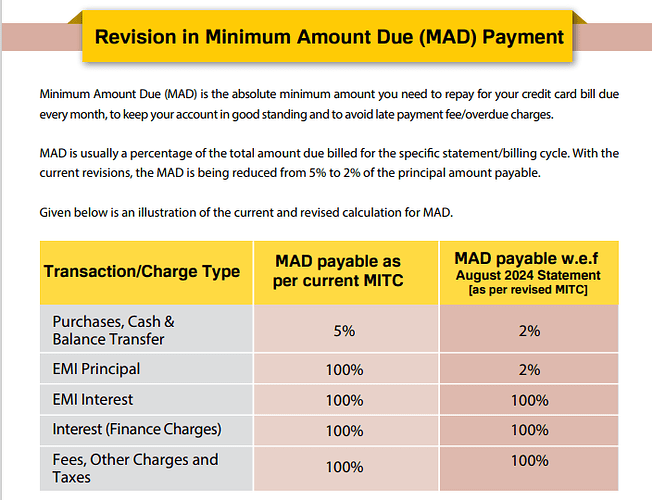

The Minimum Amount Due (MAD) is the minimum amount you must repay on your credit card bill each month to avoid late payment fees or overdue charges. Typically, the MAD is a percentage of the total amount due for a particular billing cycle.

With the recent updates, the MAD percentage is being reduced from 5% to 2% of the principal amount payable starting from August 2024.

Key Points:

- Old MAD: 5% of the total amount due

- New MAD: 2% of the total amount due

- Effective From: August 2024 statement cycle

What This Means for Cardholders

IDFC First Bank credit cardholders need to be aware of these changes to avoid incurring additional charges. The reduced MAD might seem beneficial as it lowers the immediate payment burden, but it could lead to higher interest charges over time if not managed properly. The shortened Payment Due Date requires prompt attention to statements and timely payments to avoid late fees.

- Payment Due Date: Now 15 days from statement generation

- Minimum Amount Due: Reduced to 2% of the total amount due

- Effective Date: August 2024 statement cycle

IDFC First Bank credit cardholders, how do you feel about these changes? Will the new payment due date and revised MAD impact your financial planning?