1. Understanding Your Credit Card’s Lounge Access Benefits

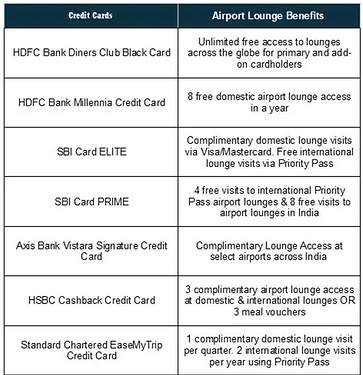

To make the most of airport lounge access, start by understanding the advantages offered by your credit card. Many credit cards, especially premium ones, provide complimentary lounge access. Banks like HDFC Bank, SBI, and Axis Bank often include this benefit.

2. Registering for Lounge Access

Some credit cards require separate registration for lounge access. For instance, if your card offers access through programs like Priority Pass or Lounge Key, you’ll need to activate your membership. This usually involves filling out a form or contacting customer service. Make sure you have your membership card or digital access ready before heading to the airport.

3. Planning Your Visits

- Check Available Lounges: Before your trip, review the list of lounges at your departure and transit airports. Most credit card issuers provide a list of partner lounges on their websites or apps.

4. Understanding the Limitations

- Guest Restrictions: Many lounges limit the number of guests you can bring. If traveling with family or friends, check whether they can enter with you or if there’s an additional fee.

- Time Limits: Some lounges have time limits on how long you can stay, especially during peak hours.

5. Explore Additional Travel Perks

Besides lounge access, look for other travel-related benefits like travel insurance, air miles, and concierge services to enhance your travel experience further.